UGC Creator Taxes Explained | Northern Virginia CPA Guide

UGC Creator Taxes treat creators as self-employed individuals. Income from brand deals, platform payouts, and affiliate sales must be reported on Schedule C and may trigger self-employment tax. Both cash and non-cash compensation must be included, and creators can deduct ordinary and necessary business expenses such as equipment, software, props, and a qualifying home office.

Understanding UGC Creator Taxes and IRS Rules

This video is AI-generated — just like many tools UGC creators already use. While the narrator is AI, the tax guidance comes directly from me as a licensed CPA working with creators every day.

As a licensed CPA serving clients throughout Northern Virginia and nationwide, I work with many digital creators who need straightforward tax guidance that applies to multi-platform income.

User-Generated Content (UGC) creators and influencers now operate like small businesses, even if they start as side hustlers. Whether you earn income from TikTok, Instagram, YouTube, Etsy, OnlyFans, or direct brand collaborations, the IRS treats your earnings as business income. That means you’re responsible for tracking revenue, deducting eligible expenses, and planning ahead for taxes. As a CPA who works with digital creators, I’ll break down exactly how UGC income is taxed, what you can deduct, and what creators often overlook.

If a brand pays you to create content—whether you post it on your own page or they use it in their ads—it’s taxable business income.

This includes income from:

- TikTok Sponsored Posts

- Instagram Reels for brand campaigns

- UGC videos delivered directly to companies

- OnlyFans, Fanbase, or subscription platforms

- Etsy digital products or templates

- YouTube ad revenue and memberships

- Amazon or LTK affiliate commissions

- Twitch live-streaming revenue

- Patreon or Ko-fi paid subscriptions

Even “free products” can be taxable if you received them in exchange for creating content.

From a tax perspective, you are operating a business, even if it started as a hobby or side hustle.

Do UGC and Creators Pay Self-Employment Tax?

Yes.

In addition to regular income tax, creators pay self-employment tax, which covers Social Security and Medicare.

It applies to your net income (income minus legitimate business expenses).

You calculate this on Schedule SE.

If you expect to owe more than about one thousand dollars for the year, the IRS usually requires quarterly estimated tax payments.

This is where many creators get into trouble—platforms don’t withhold taxes, so you need to plan ahead.

What Can UGC Creators Deduct? (CPA-Verified, Accurate List)

As a CPA, I always recommend keeping deductions accurate, defensible, and clearly business-related.

Below is a list of common deductions creators often take, but only when used for your business.

Equipment and Production Costs

- Cameras, DSLR or mirrorless

- Smartphones used primarily for filming

- Lighting kits, ring lights

- Microphones, audio equipment

- Tripods, gimbals, stabilizers

- Editing laptops or monitors

Software and Apps

- Editing software like Adobe Premiere, Final Cut, CapCut Pro

- Graphic design tools like Canva Pro

- Social media schedulers like Later, Buffer, Hootsuite

- Cloud storage such as Google Drive, iCloud, Dropbox

- Link-in-bio tools if used for your business

Home Office (If You Qualify Legally)

You must use the space exclusively and regularly for your business.

If you meet the IRS test, you may deduct:

- Portion of rent or mortgage interest

- Utilities

- Internet (percentage used for business)

Props, Sets, and Supplies

These must be used exclusively for your content to be deductible.

General clothing and everyday items are usually not deductible unless they are costumes and unsuitable for street wear.

Website and Marketing

- Website hosting

- Domain fees

- Online ads

- Digital portfolio services

- Professional branding help

Travel for Content Projects

If you travel specifically for a brand project or content shoot, you may deduct:

- Airfare

- Lodging

- Mileage

- Transportation

- Fifty percent of business meals during travel

Travel must have a clear business purpose.

Professional Services

- CPA fees

- Legal consultations

- Paid editors or VAs

- Brand management or production support

These are directly tied to your business and fully deductible.

What Content Creators Should Not Deduct (Common Misunderstandings)

Creators often get confused here. The IRS does not allow:

- Everyday clothing you can wear in normal life

- Makeup used for both personal and business purposes

- Traveling for personal reasons and also “posting content” while away

- Mixed-use items without proper allocation

- Personal meals

- Personal cell phone costs without a business-use calculation

As a CPA, I always emphasize that deductions must be reasonable, ordinary, and necessary for your business.

Do UGC Creators Need an LLC or S-Corporation?

LLC

An LLC can give you:

- Professional appearance to brands

- Business separation

- Clean bank accounts

- Room to grow

However, it does not change your federal tax treatment unless you elect S-Corporation status.

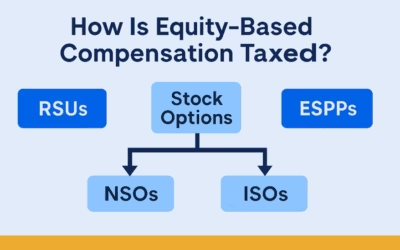

S-Corporation

I generally begin discussing an S-Corporation only after consistent net income reaches a level where the tax savings outweigh the cost of payroll, bookkeeping, and corporate tax filings.

This threshold is different for each creator and depends on stability, income patterns, and administrative budget.

For many creators, S-Corp conversations start once they are earning meaningful, stable profit, but it is not something to rush into prematurely.

Best Practices for Creators to Stay Organized

- Keep a separate bank account for creator income

- Track your income from all platforms (including gifts and sponsorships)

- Store receipts and categorize expenses monthly

- Use bookkeeping software or spreadsheets

- Maintain a mileage log if you drive for content shoots

- Set aside money for quarterly taxes

Proper organization saves creators from IRS problems later.

Why Work With a CPA Who Understands Content Creators?

In Northern Virginia’s growing creator and tech community, I see more UGC creators earning multi-platform income than ever before — and with that comes more complex tax questions.

Content creation is a real business, and tax rules for creators evolve quickly—especially with new 1099-K thresholds, multi-platform income, and complex deductions.

A CPA who understands the online creator economy can help you:

- Maximize legitimate deductions

- Avoid IRS issues

- Plan for quarterly taxes

- Decide when an entity structure makes sense

- Understand platform payouts and reporting

- Manage multi-state or international issues

- Build long-term financial systems

Creators often come to me after receiving an IRS notice or realizing they underpaid taxes.

Starting early makes everything easier.

If you’re earning income as a UGC creator in Northern Virginia or anywhere in the U.S., you can schedule a consultation at aitaxconsulting.com for clear, accurate CPA guidance.

Do UGC creators have to pay taxes?

Yes. UGC creators are classified as self-employed. You must report all income, including brand payments, affiliate commissions, platform payouts, and gifted products provided in exchange for content.

Are gifted products taxable?

If a brand gives you a product in exchange for content, it is taxable. If the gift was truly unsolicited with no expectation of content, it may not be taxable.

Do UGC creators need to file quarterly taxes?

If you expect to owe more than $1,000 in taxes for the year, the IRS generally requires quarterly estimated tax payments.

Should creators get an LLC or S-Corp?

LLCs provide business separation and professionalism. S-Corps may reduce self-employment tax, but only after consistent profit high enough to justify payroll and bookkeeping costs.

What deductions can UGC creators take?

Common deductions include equipment, lighting, props, software, cloud storage, home office (if eligible), travel for content projects, and professional services like CPA fees.

Can creators deduct everyday clothing?

No. Clothing must be a costume or unsuitable for regular use to qualify as a deduction.

Do creators receive 1099s?

You may receive 1099-NEC or 1099-K from platforms, but you must report income even if you don’t receive any forms.