Equity Compensation Taxes Made Simple

A Practical Guide to RSUs, Stock Options, and ESPP Shares for Tech Workers in Northern Virginia and Nationwide

Equity Compensation Taxes apply when employees receive RSUs, stock options, or ESPP shares as part of their pay. These awards are taxed differently, and many tech workers overpay because they misunderstand vesting dates, cost basis, and sale rules. Whether you work in Northern Virginia or anywhere in the U.S., this guide explains how each type of equity compensation is taxed and how to avoid common reporting mistakes.

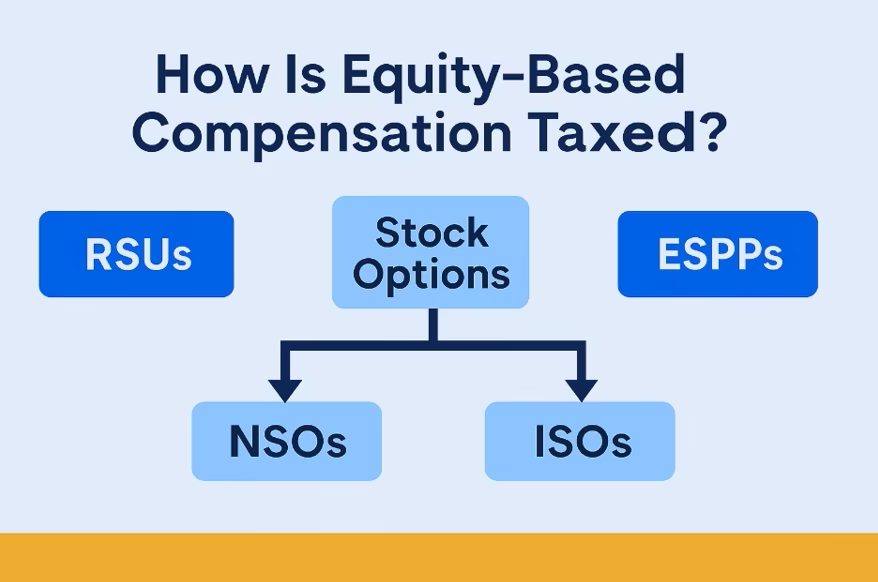

What Is Equity Compensation?

Equity compensation means your employer rewards you with stock or the right to buy stock. The most common types include:

• RSUs – Restricted Stock Units

• Stock Options – ISOs and NSOs

• ESPP Shares – Employee Stock Purchase Plans

• Less commonly: SARs (Stock Appreciation Rights) and Phantom Shares

These awards are widely used by companies such as Amazon, AWS HQ2, Google, Microsoft, Meta, Capital One, and many startups and government contractors across Northern Virginia, DC, and Maryland.

How RSUs Are Taxed

When RSUs Become Taxable

RSUs are not taxed when granted.

They are taxed when they vest.

On the vesting date:

• The fair market value of the shares becomes W-2 wage income

• This income is taxed like salary or a bonus

• Employer withholding is often too low, causing April tax balances due

RSU Example

Jamie has 100 RSUs vest at $50.

She owes tax on $5,000 of W-2 income.

If Jamie sells later:

• Sells at $60 → $10 per share = capital gain

• Sells at $45 → $5 per share = capital loss

How Stock Options Are Taxed

Stock options come in two major types, each with different tax rules.

Non-Qualified Stock Options (NSOs)

When NSOs Are Taxed

You owe tax when you exercise.

Tax at exercise = market price – strike price

This amount becomes W-2 income.

Any additional gain after exercise is a capital gain.

NSO Example

Maya has 500 NSOs with a $10 strike price.

She exercises when the stock is $40.

• $40 – $10 = $30 per share

• $30 × 500 = $15,000 W-2 income

If she sells immediately → no extra tax

If she sells later at $55 → $15 per share = capital gain

Incentive Stock Options (ISOs)

ISOs offer potential tax benefits but come with stricter rules. Read IRS guidance on ISOs and stock options taxation

When ISOs Are Taxed

You do not owe regular income tax when exercising ISOs.

But the spread may trigger AMT (Alternative Minimum Tax).

To receive favorable long-term capital gains, you must:

• Hold shares 1 year after exercise, and

• Hold shares 2 years after the grant date

Selling earlier = disqualifying disposition, causing ordinary income.

ISO Example

Sam exercises 1,000 ISOs at $10 when the stock is $25.

He sells later at $30, satisfying both holding periods.

Result: Most of the gain is long-term capital gain, not ordinary income.

How ESPP Shares Are Taxed

Many companies offer ESPPs allowing employees to buy stock at a 5–15% discount.

How ESPP Discounts Are Taxed

The discount is treated as compensation, often added to your W-2.

ESPP Holding Rules

To receive favorable tax treatment:

• Hold shares 1 year after purchase

• AND 2 years after the offering date

Selling sooner means more of the gain becomes ordinary income.

ESPP Example

Leah buys 200 shares at $8 when market value is $10.

She sells later at $15.

• $2 discount = ordinary income

• $5 additional gain = capital gain

Quick Comparison: How Common Equity Awards Are Taxed

This table gives a simple overview of when different types of equity compensation become taxable and what kind of tax applies.

| Type of Equity | When Taxed | Tax Type | Simple Example |

|---|---|---|---|

| RSUs | At vesting | W-2 income at vesting; capital gain or loss when sold | 100 RSUs vest at $50 → $5,000 added to W-2. |

| NSOs | At exercise | W-2 income on the spread; capital gain or loss when sold | Strike $10, stock $40 → $30 income per share at exercise. |

| ISOs | Generally at sale; AMT possible at exercise | Potential AMT; long-term capital gain if holding rules are met | Exercise at $10 when stock is $25, sell at $30 → long-term gain if holding period is met. |

| ESPP | Discount at purchase; gain at sale | Discount = ordinary income; remaining gain may be capital gain | Buy at $8 when worth $10 → $2 ordinary income per share. |

Common Reporting Mistakes That Increase Equity Compensation Taxes

Many taxpayers overpay because of simple but costly errors:

1. Not correcting cost basis on 1099-B

Brokerage statements often show zero basis for RSUs and ESPPs.

2. Not providing supplemental statements

DIY software cannot calculate correct basis without grant/vesting details.

3. Using uncredentialed preparers

Many do not understand AMT, sourcing rules, or multi-state issues.

4. Under-withholding on RSUs and options

Flat supplemental withholding is often too low for high earners.

5. Multi-state taxation issues

Multi-state taxation issues arise in many tech hubs across the U.S., including Northern Virginia, DC, Maryland, California, Washington, New York, and Texas. Because equity income is usually sourced to where the underlying work was performed, remote and hybrid workers often need multi-state apportionment and multiple state returns.

Best Practices to Stay Organized and Avoid Overpaying

• Keep all vesting, exercise, and sale confirmations

• Track and adjust cost basis correctly

• Confirm equity income is included on your W-2

• Increase withholding or make estimated payments

• Track special holding periods for ISOs and ESPPs

• Work with a CPA experienced in equity compensation

Final Thoughts

Equity compensation can be a powerful wealth-building tool, but the tax rules are complex. RSUs, stock options, and ESPP shares each have unique rules that can impact your tax bill significantly.

Whether you work in Northern Virginia’s innovation corridor or anywhere else in the U.S., accurate reporting protects you from penalties and prevents you from overpaying.

AI Tax Consulting PLLC provides specialized help for employees with RSUs, stock options, ESPPs, AMT issues, and multi-state equity taxation.

When do RSUs become taxable and how are they taxed?

RSUs are not taxed when granted but are taxed upon vesting. At vesting, the fair market value of the shares is considered W-2 wage income and taxed like salary or a bonus, often leading to under-withholding. If sold later, capital gains or losses are calculated based on the sale price.

What common mistakes lead to overpaying taxes on equity compensation and how can they be avoided?

Common mistakes include failing to correct cost basis on 1099-B, not providing supplemental statement details, using uncredentialed preparers, under-withholding on RSUs and options, and neglecting multi-state taxation issues. To avoid these, keep detailed records, work with experienced CPAs, and ensure proper withholding and reporting.

What are equity compensation awards and which types are most common?

Equity compensation awards are rewards given by employers in the form of stock or the right to purchase stock. The most common types include RSUs (Restricted Stock Units), stock options (ISO and NSO), and ESPP shares, along with less common awards like SARs and phantom shares.

How are stock options taxed, and what are the differences between NSOs and ISOs?

NSOs are taxed when exercised, with the market price minus the strike price becoming W-2 income, and any additional gain as a capital gain. ISOs do not generate regular income tax at exercise but may trigger AMT; they offer favorable long-term capital gains if holding rules are met, with taxes due at sale.

What are the tax rules for ESPP shares and how does holding period affect taxation?

ESPP shares are taxed with the discount treated as compensation and added to W-2 income. To benefit from favorable tax treatment, shares must be held for at least one year after purchase and two years after the offering date. Selling earlier results in more ordinary income being taxed.