Understanding Military Tax Residency, PCS Moves, Spouse Rules, Deployment Benefits, and Common Filing Mistakes Military tax questions often become complicated for service members who move frequently, deploy, […]

TaxBlog

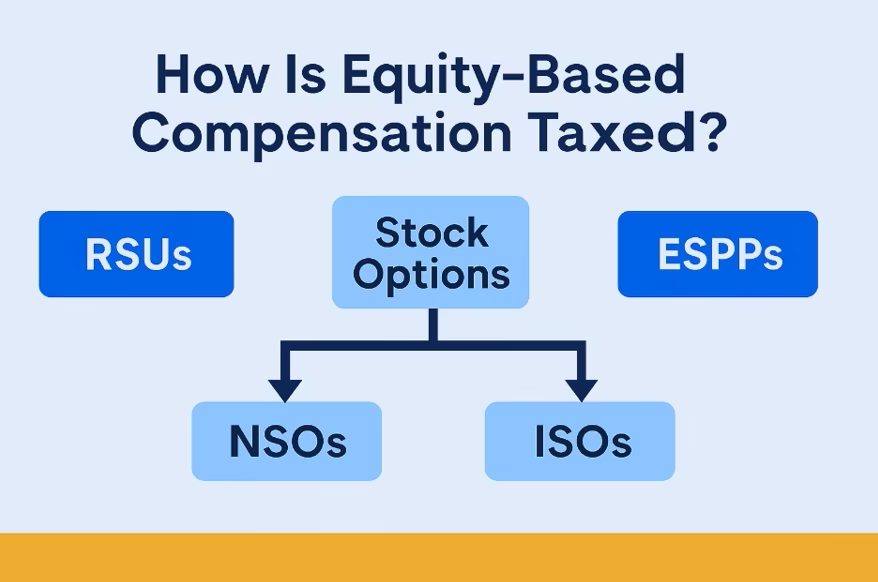

Equity Compensation Taxes Made Simple

A Practical Guide to RSUs, Stock Options, and ESPP Shares for Tech Workers in Northern Virginia and Nationwide Equity Compensation Taxes apply when employees receive RSUs, stock […]

UGC Creator Taxes Explained | Northern Virginia CPA Guide

This includes income from: Even “free products” can be taxable if you received them in exchange for creating content. From a tax perspective, you are operating a […]

Reasonable Compensation for S-Corp Owners: A CPA’s Guide

One of the most important rules for S-Corporations is setting reasonable compensation for S-Corp owners. This requirement determines how much salary you must pay yourself before taking […]

2025 One Big Beautiful Bill Act OBBBA Tax Changes for Individuals

The One Big Beautiful Bill Act (OBBBA) was signed into law on July 4, 2025. This landmark legislation permanently extends many tax provisions originally introduced by the […]

Tax Tips for Real Estate Agents: What You Need to Know About 1099 Income

As a real estate agent, you’re likely receiving a Form 1099-NEC instead of a W-2. That makes you self-employed in the eyes of the IRS — and […]

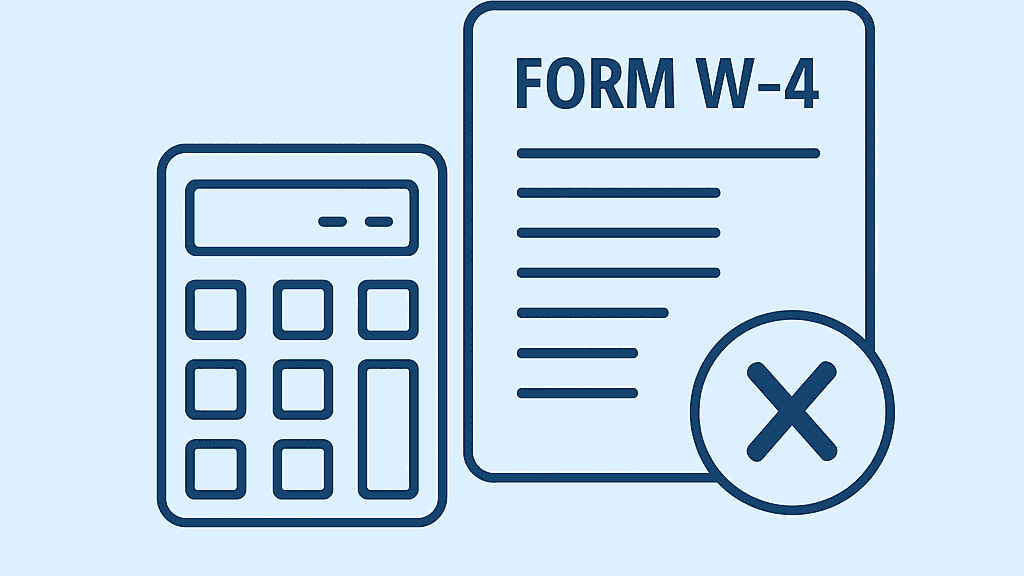

Always Owe at Tax Time? W-2 Earners: Here’s How to Fix Your W-4

Tired of owing taxes every April even though you have a full-time job? If you’re a W-2 wage earner — especially married with more than one job […]

Why S Corporations Aren’t Always a Smart Move

S Corporations are often marketed as a magic tax-saving tool. From viral TikTok videos to well-meaning accountants, it’s easy to get the impression that electing S Corp […]

We’ve Moved! AI Tax Consulting PLLC – CPA in Fredericksburg VA Now Welcoming Clients

We’re excited to announce that AI Tax Consulting PLLC, your trusted CPA in Fredericksburg, VA, has officially opened its new office! 📍 New Address:145 Harrell Rd, Suite […]

Military Tax Tips for Service Members in the DMV

Military families in the DMV region (DC, Maryland, Virginia) face unique challenges at tax time — from PCS moves to combat pay exclusions to navigating joint filings […]

Vacation Home Tax Breaks: A Virginia CPA’s Guide

Summer rentals have been stronger than ever, and purchases of vacation homes are on the rise. If you own a vacation property in Virginia Beach, Lake Anna, […]

The Tax Benefits of Owning a Home

IRS Penalties: Failure-to-File & Pay | CPA Stafford VA

If you live in Stafford, Fredericksburg, or Northern Virginia, understanding IRS penalties is essential. Whether you file late or cannot pay on time, the IRS can assess […]

Educational Tax Credits for Taxpayers That Help Pay Higher Education Costs

Tips About Rental Income and Expenses

Do you have a rental rental property that you rent property to others? If so, you’ll want to read the following seven tips about rental income and […]