TAX BLOG

Tax Tips and Tax Law Changes

Military Tax Guide for Service Members in Northern Virginia

Understanding Military Tax Residency, PCS Moves, Spouse Rules,

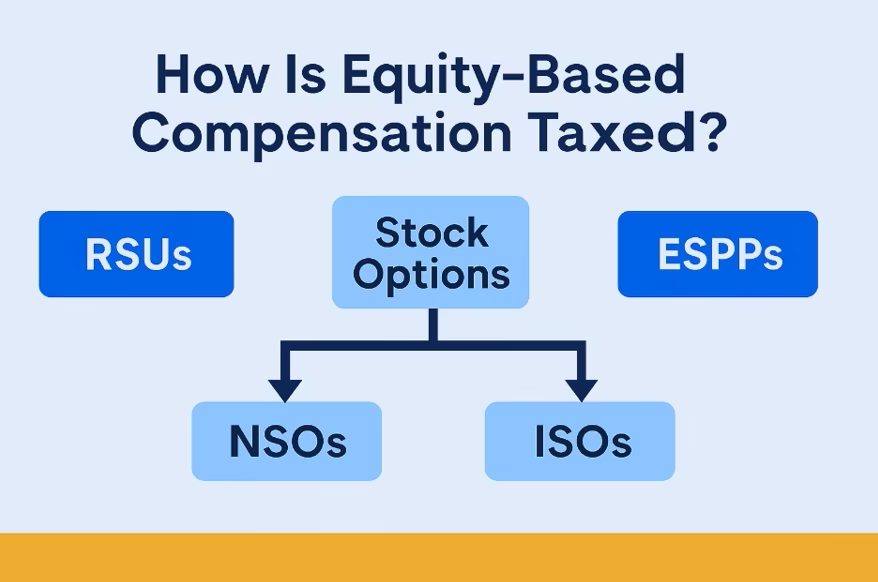

Equity Compensation Taxes Made Simple

A Practical Guide to RSUs, Stock Options, and ESPP Shares for Tech

UGC Creator Taxes Explained | Northern Virginia CPA Guide

UGC Creator Taxes treat creators as self-employed individuals. Income

Reasonable Compensation for S-Corp Owners: A CPA’s Guide

One of the most important rules for S-Corporations is setting

2025 One Big Beautiful Bill Act OBBBA Tax Changes for

The One Big Beautiful Bill Act (OBBBA) was signed into law on July 4,

Tax Tips for Real Estate Agents: What You Need to Know

As a real estate agent, you’re likely receiving a Form 1099-NEC

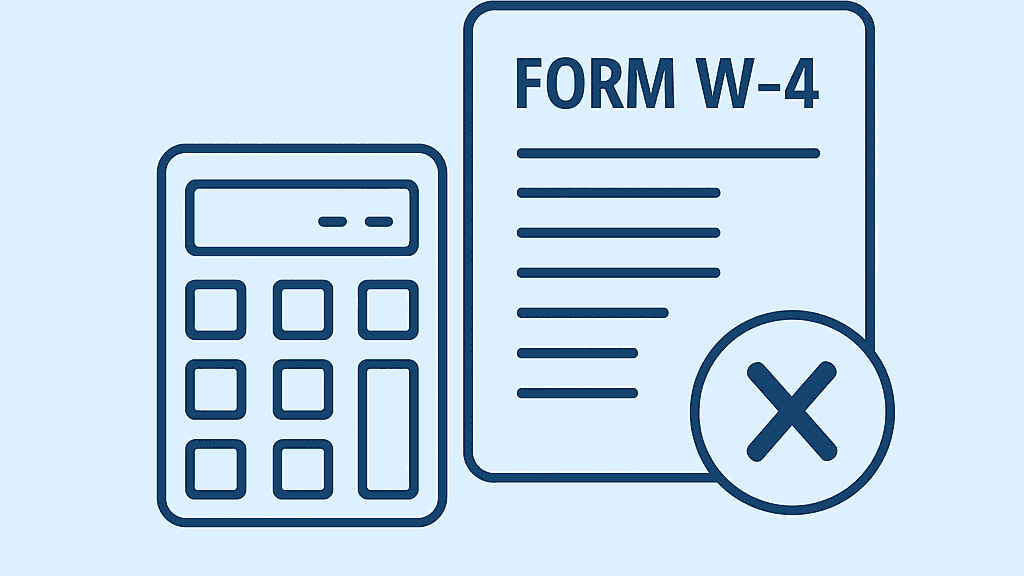

Always Owe at Tax Time? W-2 Earners: Here’s How to

Tired of owing taxes every April even though you have a full-time job?

Why S Corporations Aren’t Always a Smart Move

S Corporations are often marketed as a magic tax-saving tool. From

We’ve Moved! AI Tax Consulting PLLC – CPA in

We’re excited to announce that AI Tax Consulting PLLC, your trusted

Military Tax Tips for Service Members in the DMV

Military families in the DMV region (DC, Maryland, Virginia) face

Vacation Home Tax Breaks: A Virginia CPA’s Guide

Summer rentals have been stronger than ever, and purchases of vacation

The Tax Benefits of Owning a Home

One of the main reasons people purchase a home is the psychological

IRS Penalties: Failure-to-File & Pay | CPA Stafford VA

If you live in Stafford, Fredericksburg, or Northern Virginia,

Educational Tax Credits for Taxpayers That Help Pay Higher

The American Opportunity Credit and the Lifetime Learning Credit may

Tips About Rental Income and Expenses

Do you have a rental rental property that you rent property to others?

Comparison of various form of entities when starting new

Comparing Business Entity Types: Which Structure is Right for You?

IRS Opens Address Change Portal for Advance CTC Payments –

IRS Opens Address Change Portal for Advance CTC Payments – Did You

Tracking Tips income – Did You Know?

Tracking Tips Income: What Service Workers Need to Know If you work in

- 1

- 2